Climate Action

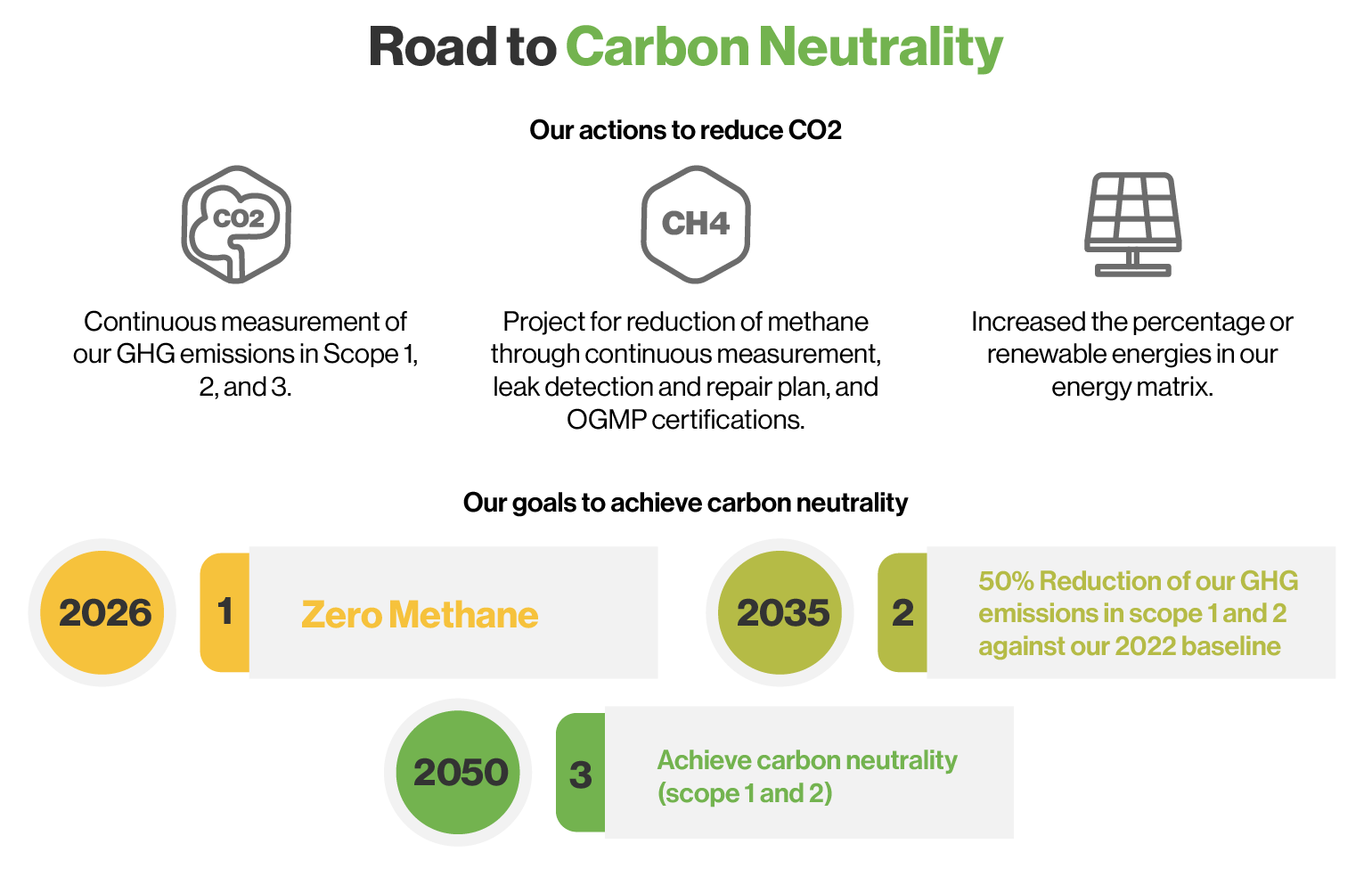

Mindful of the imperative to address the challenges of climate change, Canacol has joined the global initiative of the Paris agreement. This accord aspires to restrict the rise in temperature increase to 1.5°C above pre-industrial levels. Consequently, we have made a resolute commitment to reduce our greenhouse gas emissions, increase our resilience to risks stemming from climate variability, and adopt measures to both adapt to and mitigate the impacts of climate change.

As a result, the Company has set itself an ambitious agenda, aiming to achieve carbon neutrality by 2050. In pursuit of this objective, we aim to reduce our GHG emissions (Scope 1 and 2) by 50% by 2035 in relation to our 2022 baseline emissions. Additionally, we are determined to achieve zero methane emissions by 2026.

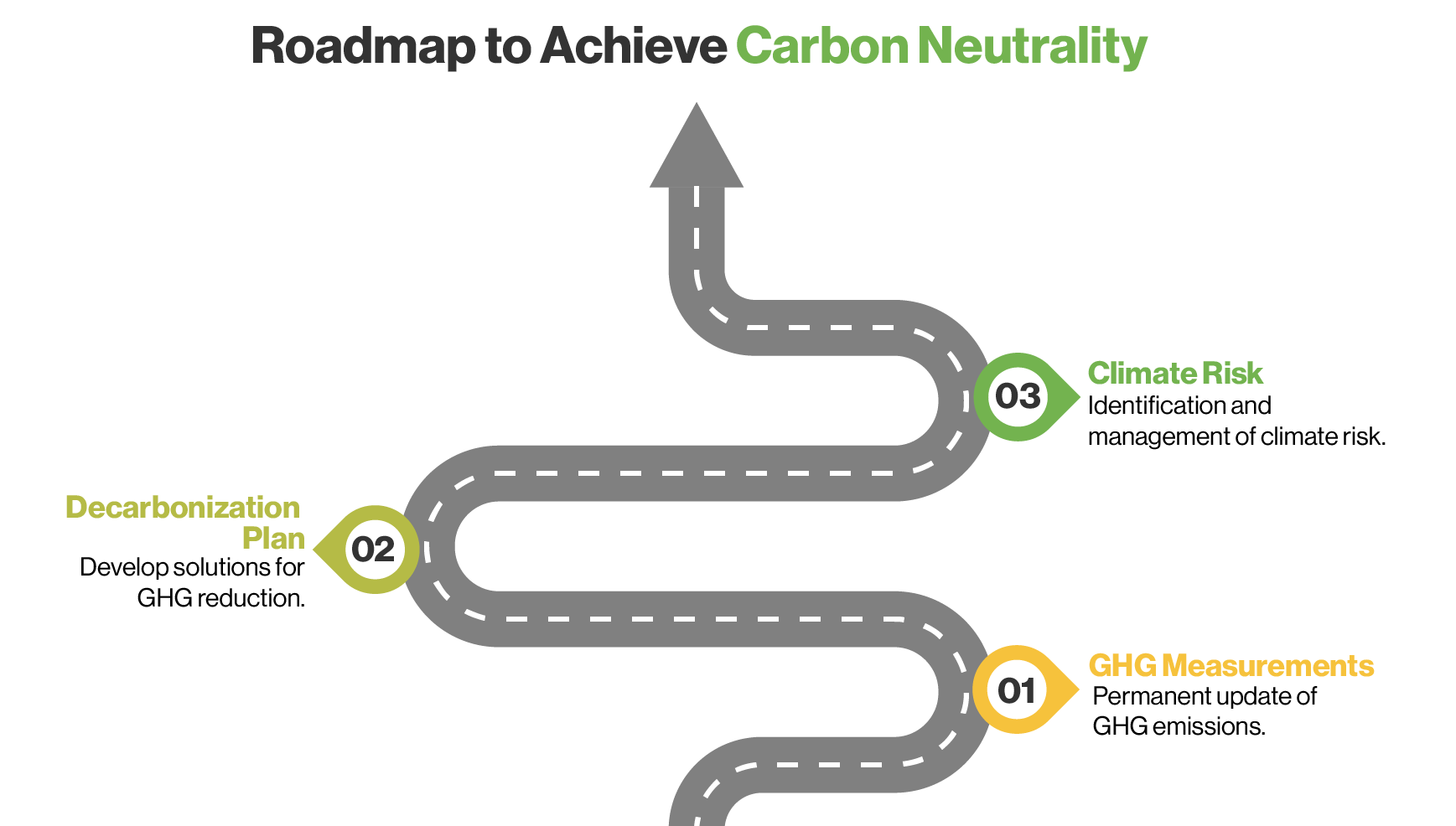

- Systematic control and monitoring of greenhouse gas (GHG) emissions. We have implemented a rigorous measurement process, performed by an independent third party, to accurately quantify our greenhouse gas emissions on an annual basis. This practice ensures an accurate and responsible environmental management process within our operations. The measurement adheres to the Corporate Standard of the GHG Protocol.

- Operational efficiency and technology as drivers of decarbonization. Our roadmap encompasses a series of actions in the short, medium, and long term. This ranges from identifying and correcting leaks to eliminating uncontrolled emissions, to improving efficiency and reducing flaring and venting in wells. Furthermore, our roadmap encompasses the significant expansion of renewable energy projects, thus establishing a solid foundation for a sustainable energy transition.

- Natural climate solutions to increase carbon storage and prevent biodiversity loss. Our goal is to cultivate an array of Natural Climate Solutions (NCSs), essential to achieving decarbonization goals. Additionally, these solutions generate social development, employment opportunities, and protection for communities.

- Incorporation of climate risk assessment into decision-making, commercial and expansion strategies, and operational processes. We conduct a thorough identification and management of climate risks within the TCFD framework, strengthening our resilience against environmental challenges. This proactive approach allows us to implement effective measures to mitigate potential impacts on both our environment and operations. All climate risks are reported to the Executive Committee and the Audit Committee.

- Development of mechanisms to promote the adaptation of communities in our operational areas. We enable access to clean energies in the Sucre and Córdoba departments via the Canacol Gas Massification project. This initiative substitutes wood and other traditional fuel sources with a local public gas distribution service.

Our Objectives

With an unwavering commitment to sustainability, our decarbonization goals are designed to significantly reduce our carbon footprint.

Incentives for Climate Management

Since the year 2022, the variable compensation of the executive team, which includes a year-end cash bonus, is linked to the attainment of 100% of the annual ESG objectives. These objectives encompass initiatives such as formulating a corporate plan for carbon reduction and offsetting, complete with specific goals, activities, and associated costs for 2023. Enhancing the Company’s ESG performance index is another key indicator determining the variable compensation of the executive team.

For further details regarding our incentives, please refer to 2023 CDP Climate Change Questionary.

Climate Change Management

Governance Structure

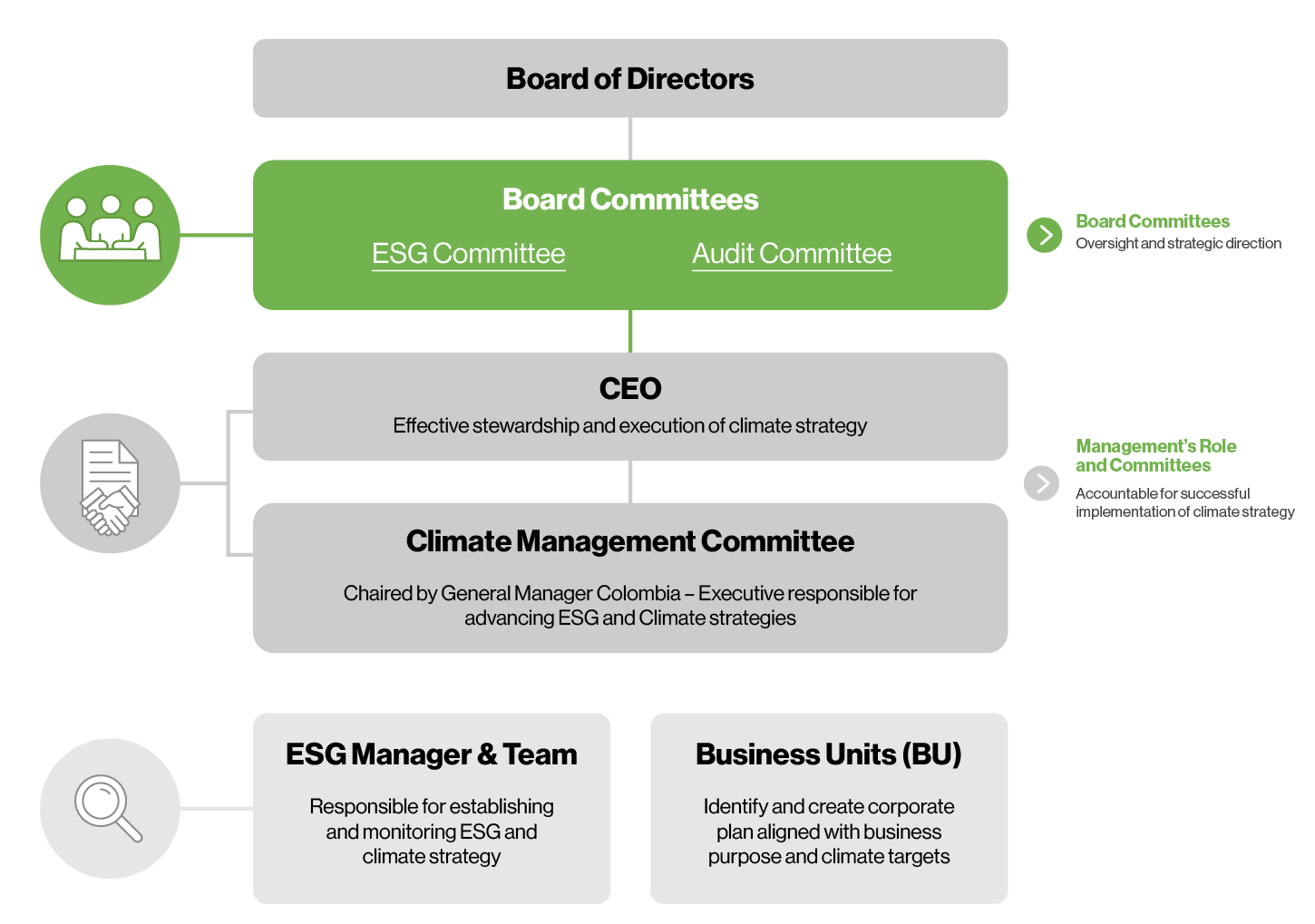

The board of directors recognizes the importance of climate change and exercises oversight of all climate-related risks and opportunities. Canacol’s ESG Committee is responsible for ensuring the integration of the Company’s sustainability strategy, climate-related risk management, and emissions reduction roadmap into the business plan, long-term strategic decision-making, and financial planning.

The governance structure that addresses climate issues is presented below.

The ESG Committee assumes a fundamental role as the primary body in climate-related matters, ensuring the coherent integration of climate-related risks, opportunities, and objectives throughout the corporate strategy and goals. Additionally, it is entrusted with overseeing the establishment of pertinent policies and procedures for the identification and effective management of the most significant climate risks.

The ESG Committee continuously evaluates the progression of the climate-related risk and opportunity landscape and reports its findings to the Board of Directors biannually. These findings are then considered and incorporated into the company's overall planning.

The Board oversees the advancement of these plans to uphold accountability and address challenges. The Committee convenes as necessary, but no less than twice a year.

To access more detailed information about our climate management, please refer to our 2023 TCFD Report

Climate Risks and Opportunities

As the largest independent natural gas exploration and production company in Colombia, Canacol is actively committed to embracing complete responsibility in managing the consequences stemming from climate-related risks and opportunities, along with their ramifications for the communities and the ecological landscape within our operational purview. As highlighted in our 2023 ESG Report, we have chosen to align our climate strategy with the framework delineated by the Task Force on Climate-Related Financial Disclosures (TCFD). Notably, we have integrated climate-related risks and opportunities into our governance and risk management processes.

For further insights, please refer to our 2023 TCFD Report

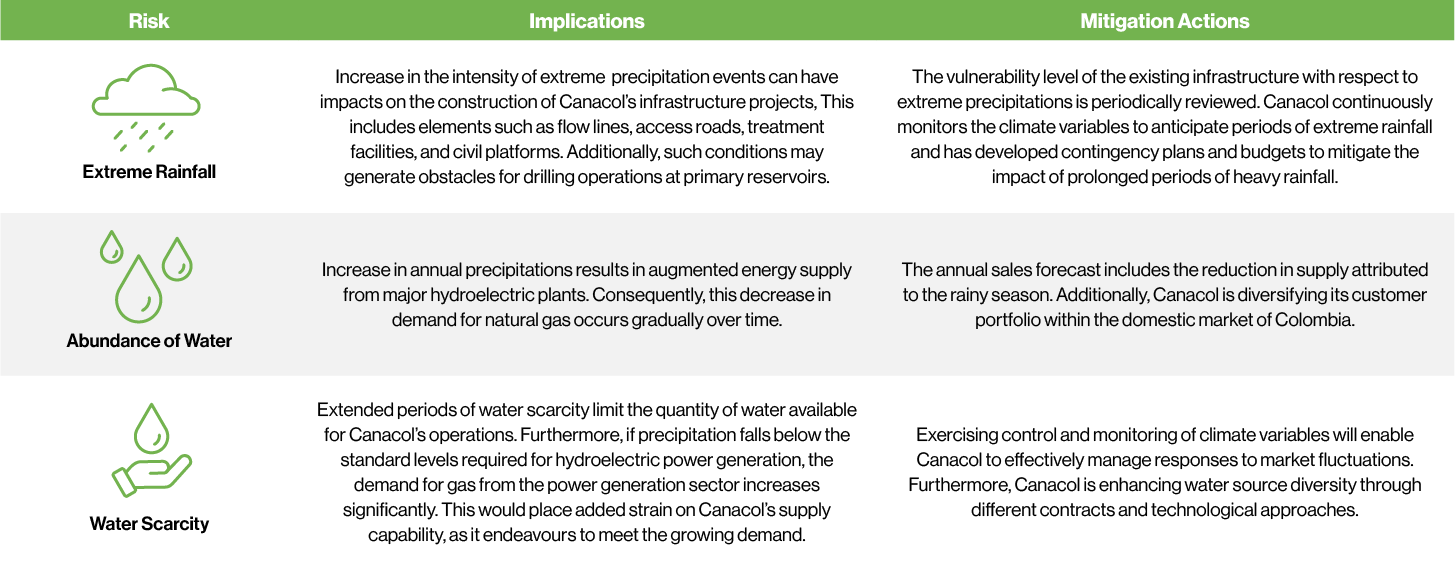

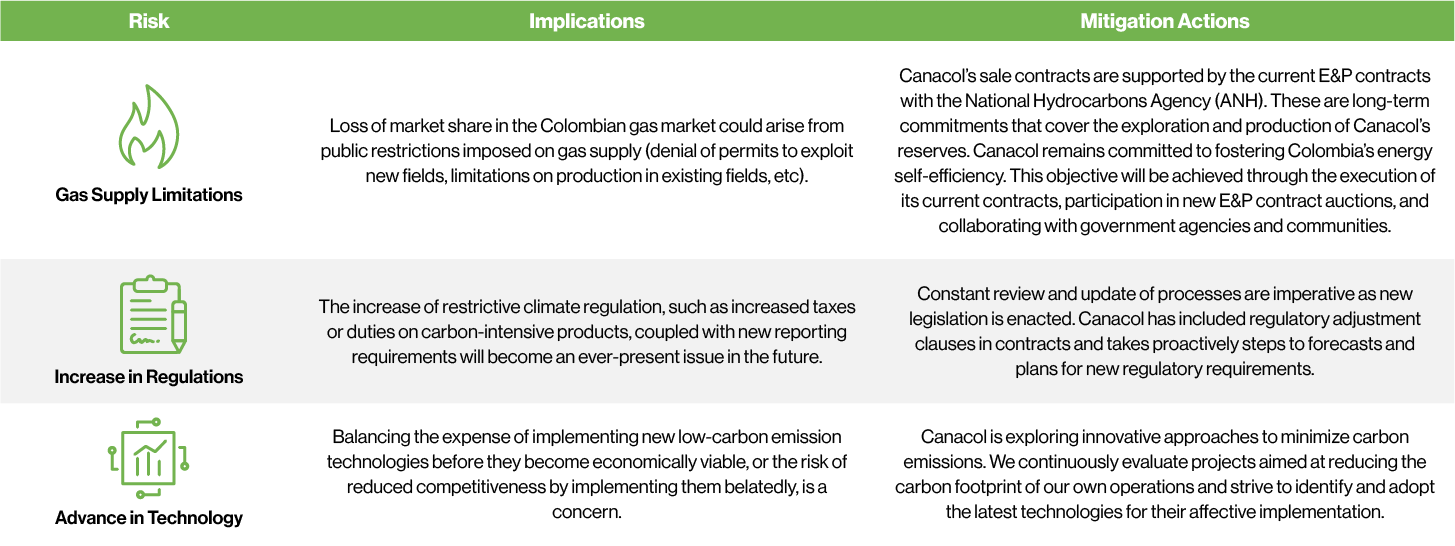

Canacol has systematically identified and evaluated climate-related physical and transitional risks at the organizational level. The critical mitigation measures to address these risks are outlined as follows. A group-wide exercise was undertaken and involved managers and personnel responsible for the ESG team and the business units. This exercise encompassed the assessment of the impact and probability of physical and transitional risks. This evaluation of climate-related risks leveraged the most recent advancements in climate research contextualized within Colombia's climate outlook, to analyze the repercussions and mitigation strategies. Presented below are three key physical and transitional risks that we have identified as priorities.

For additional details, please refer to our 2023 TCFD Report

- Financial analysis of risks

- Financial analysis of opportunities

- Climate scenarios

- Climate change adaptation and mitigation plan

Performance in Greenhouse Gas Emissions

We have established parameters and objectives to ensure the achievement of our business goals related to climate change and the energy transition. Measuring and managing carbon emissions has become a key focus across all our business units. Adhering to the guidelines of the GHG Protocol Corporate Standard, we calculate and disclose our carbon emissions, with the support of an external consultant. In the latest fiscal year (2023), we have quantified our greenhouse gas emissions, encompassing both direct and indirect emissions, covering 100% of our emissions inventory. Additionally, for a more comprehensive assessment of risks on both a corporate and value chain level, we have adopted the Wood Mackenzie Emission Benchmarking Tool. This addition enhances transparency and enables a more profound and rigorous analysis.

Emissions (Scope 1, 2, 3)

- Scope 1: 111,151.6 tCO2e

- Scope 2: 28.5 tCO2e

- Scope 3: 3,872,238 tCO2e

For additional information on our emissions, please refer to the 2023 ESG Report.

Energy

Our energy consumption metrics exemplify our low carbon operational strategy. While the growth and expansion of production have led to an increased demand for non-renewable energy, it is important to emphasize our significant strides in adopting hydropower and solar energy sources, reaching 225 MWh in 2023. Importantly, during 2023, we achieved zero consumption of diesel for power generation in our operations.

For additional information on our energy consumption, please refer to the 2023 ESG Report.