Our Approach

Our purpose is to improve the quality of life of millions of people through the exploration, production, and supply of conventional natural gas through socially and environmentally responsible operations managed in a conscious and transparent manner.

In a constantly changing world, we firmly believe in the critical role of natural gas in the energy transition and we fully support the global plans to meet the goals of the Paris Agreement. Specifically, in Colombia, we are committed to contributing to the reduction of 51% of emissions by 20301. As leaders in the production of the cleanest-burning hydrocarbon, we are committed to supplying the increasing energy demand while reducing CO2 emissions, improving air quality, and developing conditions for the growth and development of the countries where we operate, over the next 30 years or more.

At Canacol, we focus our efforts on continuous and transparent community engagement, which guarantees the implementation of social investment projects that can improve the people’s lives in neighboring communities by increasing access to water, natural gas, and education, enhancing public and community infrastructure, and supporting local productive and business development programs. We aim to develop strong relations with these communities based on a mutual benefit, balancing their needs with our corporate strategies.

All of our actions are carried out in response and to the benefit of our stakeholders, are framed in our Environmental, Social, and Governance strategy, and are based on our corporate values and objectives. Intending to become a leading company in sustainability, continuous improvement has become a fundamental axis within Canacol. Therefore, we have decided to create a comprehensive model focused on implementing and leading best practices in corporate sustainability affairs at a global level.

Our strategy is aligned with the highest international standards such as the Global Reporting Initiative, the Principles for Responsible Investment, the Carbon Disclosure Project, the Dow Jones Sustainability Index, the Principles of the Global Compact, the Sustainable Development Goals, the IFC Performance Standards, and the World Bank Group Environmental, Health and Safety Guidelines, among others. With the aim of being aligned with the expectations of our stakeholders, we are constantly searching for the best practices applicable to our business.

We recognize that sustainability is an essential path for generating value for all our stakeholders, our primary objective, so day-to-day we are firmly moving forward to consolidate it as our superior purpose.

1) Source: Ministry of Mines and Energy (2021). Energy transition: a legacy for the present and future of Colombia.

Double Materiality

At Canacol, we understand that sustainability is inseparable from responsible business management. That is why we have adopted the double materiality approach as a key tool to identify, prioritize, and manage issues that not only impact the environment and our stakeholders, but can also significantly influence the financial and operational resilience of our company.

This analysis allows us to connect our corporate strategy with environmental, social, and governance (ESG) challenges and opportunities, strengthening our ability to create long-term value and deliver concrete results that reinforce our commitment to a just and responsible energy transition.

What is Double Materiality?

Double materiality is a comprehensive approach that assesses sustainability from two key dimensions:

- Impact materiality: Evaluates how Canacol’s activities affect the environment, society, and the economy. This includes topics such as climate change, water use, biodiversity, and human rights.

- Financial materiality: Examines how ESG factors may pose risks or create opportunities for the business, affecting its finances, reputation, operations, and access to capital.

This approach is aligned with international frameworks such as the Corporate Sustainability Reporting Directive (CSRD), the European Sustainability Reporting Standards (ESRS), and the Task Force on Climate-related Financial Disclosures (TCFD), enhancing both transparency and strategic management.

Why is it Key for Canacol?

For Canacol, double materiality is not just a regulatory requirement—it is an essential tool to strengthen long-term resilience and competitiveness.

Through this biennial analysis, we identify the issues that matter most to our stakeholders and those that could significantly affect our business performance. This perspective enables us to:

- Improve strategic decision-making.

- Anticipate and manage ESG risks.

- Align our sustainability goals with corporate value.

- Reinforce our position as a global leader in a responsible energy transition.

Implementation

The double materiality analysis is part of Canacol’s integrated risk management system and is carried out through structured stages, in line with international best practices:

- Identification of relevant topics: Using frameworks such as GRI, TCFD, and ESRS, we identify key ESG topics for our sector and operational context.

- Stakeholder consultation: We conduct surveys, workshops, and interviews with employees, communities, investors, regulators, and other actors to understand their priorities and concerns.

- Impact and risk assessment: We analyze the magnitude and likelihood of Canacol’s impacts on the environment, as well as the potential financial effects of ESG risks on our business.

- Development of the double materiality matrix: We visualize the results in a matrix that reflects both the importance of each topic to stakeholders and its potential financial impact on the company.

We conduct quarterly follow-ups on the risks and opportunities associated with the Company’s material topics.

Definition of Material Topics

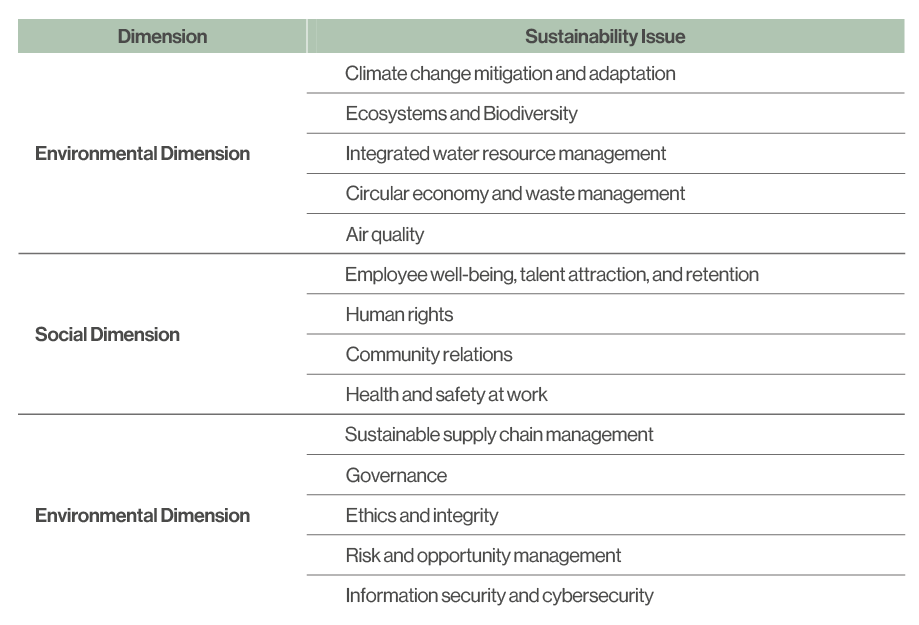

Canacol has identified 14 key material topics which guide the Company’s sustainability strategy. These are organized as follows:

For more information on our double materiality analysis, please visit the following link: Double Materiality Analysis 2024