Climate Action

Mindful of the imperative to address the challenges of climate change, Canacol has joined the global initiative of the Paris agreement. This accord aspires to restrict the rise in temperature increase to 1.5°C above pre-industrial levels. Consequently, we have made a resolute commitment to reduce our greenhouse gas emissions, increase our resilience to risks stemming from climate variability, and adopt measures to both adapt to and mitigate the impacts of climate change.

- Systematic control and monitoring of greenhouse gas (GHG) emissions. We have implemented a rigorous measurement process, performed by an independent third party, to accurately quantify our greenhouse gas emissions on an annual basis. This practice ensures an accurate and responsible environmental management process within our operations. The measurement adheres to the Corporate Standard of the GHG Protocol.

- Operational efficiency and technology as drivers of decarbonization. Our roadmap encompasses a series of actions in the short, medium, and long term. This ranges from identifying and correcting leaks to eliminating uncontrolled emissions, to improving efficiency and reducing flaring and venting in wells. Furthermore, our roadmap encompasses the significant expansion of renewable energy projects, thus establishing a solid foundation for a sustainable energy transition.

- Natural climate solutions to increase carbon storage and prevent biodiversity loss. Our goal is to cultivate an array of Natural Climate Solutions (NCSs), essential to achieving decarbonization goals. Additionally, these solutions generate social development, employment opportunities, and protection for communities.

- Incorporation of climate risk assessment into decision-making, commercial and expansion strategies, and operational processes. We conduct a thorough identification and management of climate risks within the TCFD framework, strengthening our resilience against environmental challenges. This proactive approach allows us to implement effective measures to mitigate potential impacts on both our environment and operations. All climate risks are reported to the Executive Committee and the Audit Committee.

- Development of mechanisms to promote the adaptation of communities in our operational areas. We enable access to clean energies in the Sucre and Córdoba departments via the Canacol Gas Massification project. This initiative substitutes wood and other traditional fuel sources with a local public gas distribution service.

Higher Purpose

Canacol’s higher purpose, “Building a cleaner energy future,” defines the Company’s core identity and goes beyond wealth generation. This guiding principle shapes its climate strategy and lies at the heart of its business vision, charting the course toward sustainable development.

Governance Model

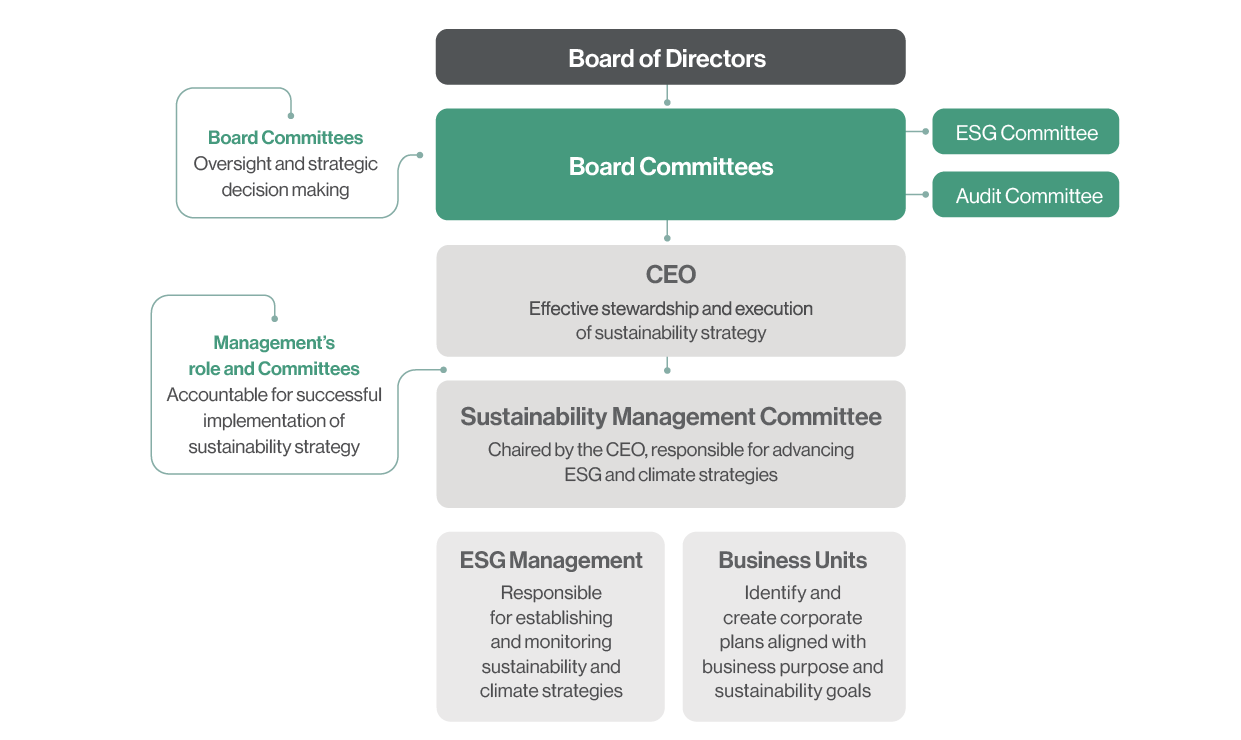

Canacol has developed a sustainability governance model that integrates climate change and energy efficiency management under a double materiality approach. This model establishes a governance structure made up of executive and operational levels, clearly defining roles and responsibilities for the design and implementation of processes, controls, and procedures. Through this structure, Canacol ensures effective oversight, management, and monitoring of climate-related impacts, risks, and opportunities.

Governance Structure

Canacol recognizes that strong and effective leadership is key to fulfilling its mission and achieving its strategic objectives. This includes fostering motivation and strengthening the commitment of its employees—key players in the Company’s success and the achievement of its executive-defined goals.

The Board of Directors, through its strategic vision and guidance, sets Canacol’s direction in the short, medium, and long term, ensuring that the Company’s actions remain aligned with its corporate values and higher purpose.

The Executive Team translates this vision into concrete actions, leveraging its leadership and experience to supervise daily operations and ensure the effective execution of business strategies.

For more information on our climate management approach, see the TCFD Report

Climate Change and Energy Efficiency Policy

The Climate Change and Energy Efficiency Policy outlines the corporate guidelines and commitments to be followed by employees, suppliers, contractors, and strategic partners. Its objective is to maximize long-term value for all stakeholders while contributing to the transition toward a low-carbon economy. For more information, refer to: Decarbonization Strategy

Strategy

Canacol’s climate change strategy focuses on the management of climate-related impacts, risks, and opportunities. The Company carries out periodic processes to identify, assess, manage, and monitor physical and transition risks, as well as associated impacts and opportunities. These processes include the analysis of current and future events through scenario modeling.

Since 2023, Canacol has identified and assessed in detail both physical and transition-related opportunities and risks, evaluating the exposure of its core assets to six material climate threats: extreme heat, extreme cold, water stress and drought, precipitation-related landslides, wildfires, and riverine flooding. This assessment involved scenario modeling across four-time horizons, aligned with the Company’s strategic planning timeline:

- Baseline: 1990–2022

- Short term: up to 2030

- Medium term: up to 2040

- Long term: up to 2050

The analysis considered climate scenarios SSP1-2.6, SSP3-7.0, and SSP5-8.5 (optimistic, neutral, and pessimistic, respectively).

Climate Risk Management

Canacol’s Integrated Risk Management System is based on ISO 31000 and structured as a five-step cyclical process. Quarterly, the Company conducts evaluations to identify, assess, manage, and disclose potential risks to the business, including climate-related risks.

The development of methodologies to identify, assess, and manage physical and transition risks—as well as climate-related opportunities—was led by the ESG Management Office with the support of the Sustainability Management Committee. This ensured the integration of these processes into the SGIR and alignment with the TCFD reporting framework and globally recognized climate scenario models.

These methodologies incorporate vulnerability assessments, enabling Canacol to understand its resilience and adaptive capacity to climate change across the short, medium, and long term. The recent double materiality assessment also helped determine the relative importance of climate-related risks and opportunities in comparison to other ESG factors—addressing a key requirement of the TCFD framework under the “Risk Management” pillar.

For more information, see the TCFD Report

- Financial analysis of risks

- Financial analysis of opportunities

- Climate scenarios

- Climate change mitigation and adaptation plan

Decarbonization and Energy Efficiency Master Plan

Canacol’s Decarbonization Master Plan focuses on reducing Scope 1 and 2 greenhouse gas (GHG) emissions across all operations and offsetting residual emissions. The plan is designed with a 2050-time horizon—aligned with the Company’s strategic planning—and supports the top-level strategic goal and associated second-level objectives.

In 2024, the Company continued to strengthen, evaluate, and propose initiatives aimed at meeting corporate decarbonization goals. These initiatives include reducing the consumption of fuels and electricity, as well as implementing specialized projects to reduce GHG emissions in a cost-effective manner. Currently, these initiatives are undergoing technical and financial feasibility assessments. They include:

- Improving energy efficiency in compressors

- Electrifying compression equipment

- Reducing emissions from gas-powered pneumatic systems

- Reducing fugitive emissions

- Expanding and improving the efficiency of the solar farm for operational self-consumption

- Gradually and partially replacing natural gas with hydrogen

- Optimizing glycol use in natural gas dehydration

- Replacing diesel and gasoline-powered trucks and vans with hybrid vehicles

- Minimizing gas flaring and venting

- Detecting and immediately repairing leaks in gas treatment, production, and transportation facilities

Key Decarbonization Milestones

- Expansion of renewable energy projects as part of the Company’s sustainable energy transition, including the installation of solar energy systems at wells and satellite facilities.

- Frequent inspections of systems and facilities to detect and correct leaks, using both internal resources and third-party support.

- Incorporation of ESG criteria into supplier selection processes, with sustainability evaluations and prioritization of those with active emission reduction strategies, energy efficiency measures, and responsible practices.

Incentives for Climate Management

Since the year 2022, the variable compensation of the executive team, which includes a year-end cash bonus, is linked to the attainment of 100% of the annual ESG objectives. These objectives encompass initiatives such as formulating a corporate plan for carbon reduction and offsetting, complete with specific goals, activities, and associated costs for 2024. Enhancing the Company’s ESG performance index is another key indicator determining the variable compensation of the executive team.

For further details regarding our incentives, please refer to TCFD Report

Management Metrics

Canacol’s sustainability and climate change management model encompasses the measurement, monitoring, and analysis of performance based on material metrics for the sector, including those required by the GRI, SASB, and IPIECA standards.

The Company’s climate strategy outlines both strategic metrics (specific to the business) and tactical metrics (linked to both the business and the aforementioned reporting standards). These metrics are consistent with the management framework defined for the material topic of “Climate Change Mitigation and Adaptation,” as identified in the most recent materiality assessment.

Below are key strategic performance indicators used to manage and analyze Canacol’s performance in relation to its climate change goals:

- KPI 1: % reduction in absolute Scope 1 and 2 GHG emissions (tCO2e)

- KPI 2: % reduction in relative Scope 1 and 2 GHG emissions (tCO2e/BOE)

- KPI 3: % reduction in absolute methane emissions (tCH4)

- KPI 4: % increase in energy efficiency per unit of production (MWh/BOE)

- KPI 5: % reduction in absolute Scope 3 emissions (tCO2e)

Greenhouse Gas Emissions Performance

The following indicators reflect Canacol’s climate performance in line with its defined strategy. Management efforts carried out in 2024 demonstrate significant progress toward the targets set for 2023: energy consumption was reduced, the share of renewable energy sources increased, and the decarbonization plan advanced, resulting in a decrease in emissions both at the corporate level and across the value chain.

Additionally, the Company strengthened its performance monitoring by externally verifying its carbon footprint and expanding the database used to calculate Scope 3 emissions.

- Scope 1: 111,151.7 tCO2e

- Scope 2: 33.3 tCO2e

- Scope 3: 3,561,080 tCO2e

In 2024, Canacol’s corporate greenhouse gas (GHG) emissions—covering Scopes 1, 2, and 3—decreased by 7.9% compared to the previous year, representing a total reduction of 316,202.5 tons of CO2e.This reduction breaks down as follows:

- Operational emissions (Scopes 1 and 2): 4.5% decrease, equivalent to -5,044.3 tCO2e

- Value chain emissions (Scope 3): 8.0% decrease, equivalent to -311,158.2 tCO2e

These results reflect the positive impact of the measures implemented under the Company’s decarbonization plan. For more information on our emissions performance, please refer to our ESG Report

Energy

Our energy consumption metrics exemplify our low carbon operational strategy. While the growth and expansion of production have led to an increased demand for non-renewable energy, it is important to emphasize our significant strides in adopting hydro-solar energy sources, reaching 226.5 MWh in 2024. Importantly, during 2024, we achieved zero consumption of diesel for power generation in our operations.

For additional information on our energy consumption, please refer to the ESG Report