Business Overview

Canacol is part of the energy transition towards a cleaner energy matrix in Colombia. Natural gas is increasingly important for Colombia as the country phases out oil and coal as energy sources, replacing them with natural gas in a transition to a cleaner, more renewable energy matrix. This will be essential in achieving the government’s target of reducing greenhouse gases (GHGs) and particulate matter, especially within large population centers. The Colombian government is committed to a 51% reduction of GHG emissions by 20301. To meet the government's target, natural gas will be critical, thus the use of gas in Colombia is expected to grow 4% annually from 2020 to 20332.

Why Gas in Colombia

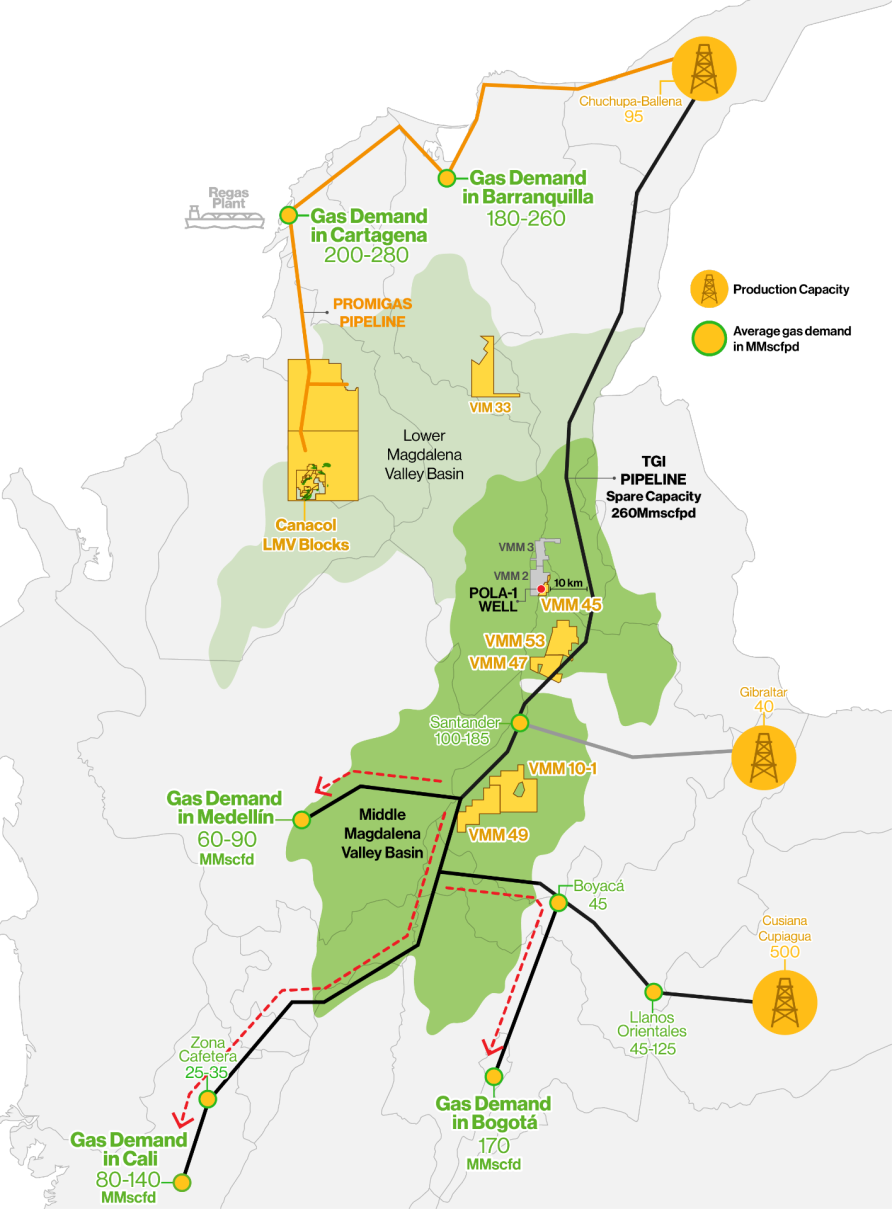

Continued production declines in the major country's large natural gas fields, coupled with growing energy demand and an increasing preference for clean-burning natural gas over coal or oil, are the ingredients of a very favorable business climate for Canacol.

Production from the country’s two largest state-owned gas fields, both discovered in the 1970s and which currently supply around 75% of the market, has been steadily decreasing since 2014. In 2012, Canacol decided to focus exclusively on conventional natural gas, where consistently high and stable prices, combined with exceptionally low production costs, support cash flow predictability and stability. Our successful exploration drilling programs have allowed Canacol to both replace the declining production from the large fields and keep up with rapidly growing gas demand, ensuring that Colombia’s gas requirements are and will continue to be met for the foreseeable future.

Currently, we are the leading independent gas exploration and production company in Colombia, supplying approximately 17% of the country’s gas needs and more than 50% of the Caribbean Coast’s gas demand.

Continuous Growth and Returns

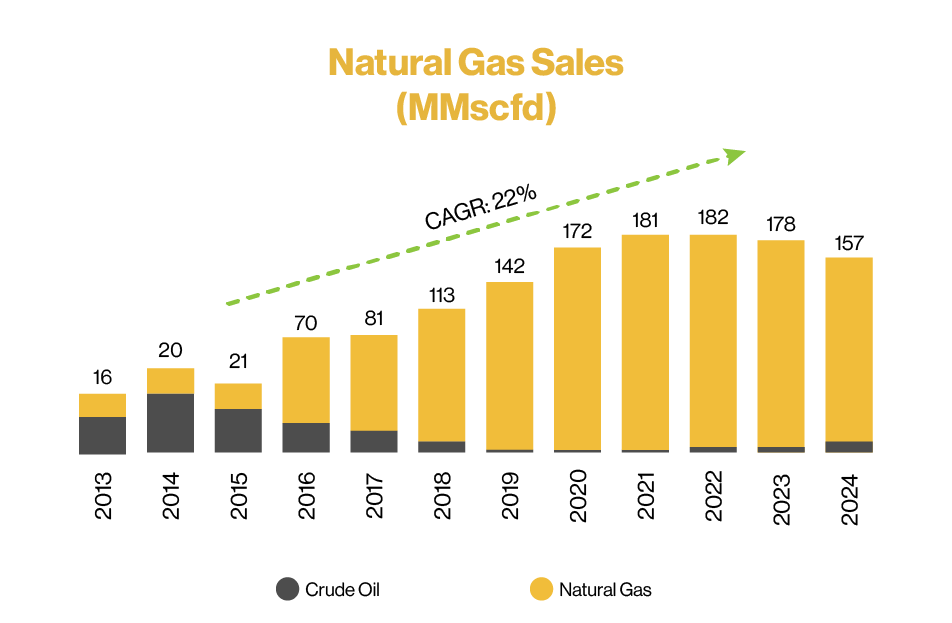

Starting in 2012 Canacol shifted from being predominantly oil-focused, to being purely gas-focused today. Via our successful exploration drilling programs, and our ability to efficiently commercialize new gas reserves, we have grown gas sales more than 10x from 2012. Our sales guidance for 2025 is between 140 - 153 million standard cubic feet per day. Our sales growth has been possible by developing and/or sponsoring new gas transportation infrastructure, creating a significant competitive edge over potential competitors.

The majority of Canacol’s gas sales are executed under USD denominated, fixed price take-or-pay contracts priced at the wellhead, which protect us from the volatility of commodity prices.

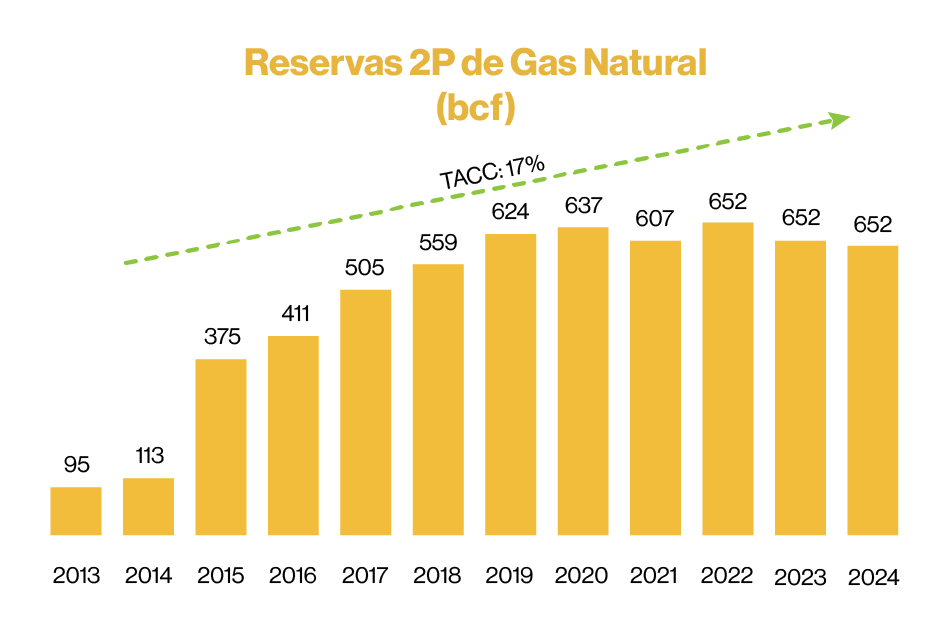

As of year-end 2024, Canacol has an impressive track record of gas exploration success of approximately 80%. Between 2013 and 2024, we have added 985 BCF of 2P conventional natural gas reserves from exploration and commercial success in 44 out of 54 drilled wells, representing a 17% CAGR in our 2P reserves.

Significant Exploration Upside

Canacol operates over 1.9 million net acres in 10 exploration and production gas contracts in Colombia, located in the Lower & Middle Magdalena Basins. Our proved plus probable (2P) gas reserves have been assessed at 599 billion cubic feet with a before tax present value, discounted at 10%, of $2.0 billion dollars3. In addition, 178 identified future exploration and development drilling prospects and leads were assessed to contain 20.5 trillion cubic feet of gross mean un-risked prospective natural gas resources4.

Aerial view of Jobo Station

1. Source: Ministry of Mines and Energy (2021). “Transición energética: un legado para el presente y el futuro de Colombia.”

2. Source: Canacol & UPME “Plan de Abastecimiento de Gas Natural” Gas demand 2020-2033

3. Source: Independent reserves report prepared by Boury Global Energy Consultants Ltd., effective December 31, 2023.

4. Source: Independent resources report prepared by Boury Global Energy Consultants Ltd, effective December 31, 2021.